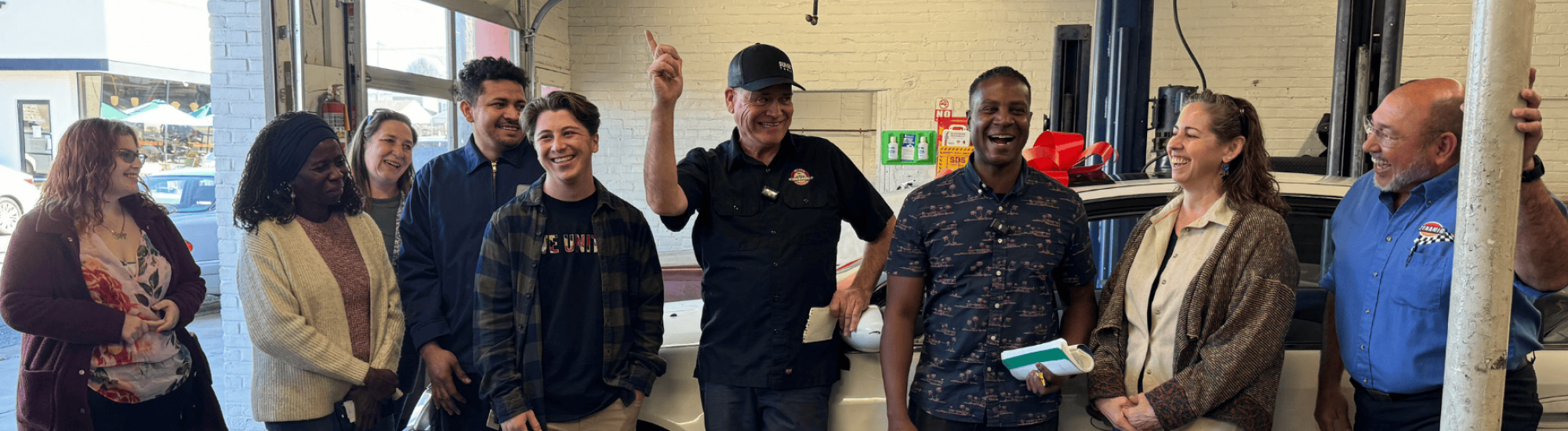

Connecting ALICE (Asset Limited, Income Constrained, Employed) Families to Safe, Reliable and Affordable Private Transportation

Transportation is identified in the ALICE Report as a major need in rural Frederick County. Access to private transportation is critical to those seeking new career opportunities, access to medical care, and opportunities to seek more suitable housing.

The ultimate outcome of the Pathway to Transportation program is moving ALICE families to a position of long-term financial stability.

How it works:

- Participants must save a portion of the total expense and participate in budget coaching to purchase a car through our program.

- The program requires participants to save only a portion of the total cost of their vehicle while maintaining a direct sale between Second Chances Garage.

- United Way of Frederick County will match each participant’s savings for the remainder of each car’s cost.

- Participants must be a current resident of Frederick County to apply for the program.

.png)

How do I apply for the program?

- Review income eligibility

- Complete the Pre-Qualification Form.

- You will receive an invitation to complete a full application if qualified.

- Upon completion of your application, you will schedule an appointment with a United Way staff member to submit required documentation.

- You will receive instructions to open a savings account with Woodsboro Bank.

- Next, you will complete the program requirement by saving a portion of the total expense and request a withdrawal form to use your savings towards the purchase of a car.

For more information, please contact Joyce Kwamena-Poh at Jkwamenapoh@uwfrederick.org.

The Pathway to Transportation is made possible thanks to our sponsors

...and donors like you. Thank you!

A special thank you to our program partners:

Car Donations

Pathway to Transportation will be successful if there are sufficient donated cars available at Second Chances Garage. If you are able, please consider a car donation. To learn more about car donations to Second Chances Garage, please visit www.secondchancesgarage.org/car-donation/.

Prosperity Accounts (also known as Individual Development Accounts – IDAs) are an innovative financial product and economic development tool used by community organizations throughout the United States to stimulate participants' savings rates, build their assets, and connect these individuals to the economic mainstream. Private foundations and the public sector fund most of the programs. The following four-step process documents how a saver moves through the Prosperity Account program.

STEP 1 – Pre-qualification and Application

All Prosperity Account savers must start the application process by submitting a Pre-qualification survey. Once a saver has pre-qualified, they will receive an email with a link to submit the full application and the next steps in the application process.

STEP 2 - Opening an IDA Account

All savers meet with a United Way administrator to review application, current household budget, discuss asset goals, review policies and procedures and complete savings plan agreement. Approved applicants will be referred to a designated financial institution for account opening.

STEP 3 - Financial Education Training

Budget Coaching and Credit Counseling are required prior to the purchase of an asset. Credit Counseling applies only to participants in the Homeownership Program. Community partners provide valuable information to help increase the likelihood of successful asset purchase and retention. 6 sessions (one hour per session) of the Budget Coach program are required.

STEP 4 - Withdrawal, Asset Purchasing, and Beyond

In Step 4, savers, with staff assistance, are ready to make bank withdrawals from their Prosperity Savings Account to purchase a reliable, used car from Second Chances Garage.

For a detailed breakdown of how the Prosperity Account program works, please refer to United Way Prosperity Account Policies and Procedures Manual.

See below for a quick list of resources explaining the process of qualification, application, and sustained participation with a Prosperity Savings Account:

- How does the Prosperity Savings Account work?

- Prosperity Center Application Information and Documentation

- Prosperity Savings Account Car Program Manual

Other Resources

Am I automatically accepted in the program if I meet all of the necessary requirements?

Applicants are admitted into the program if they complete the application process and are approved to open a Prosperity Savings Account.

This sounds like a great deal, but I thought there was no such thing as free money. What's the catch?

There's no real catch to the Prosperity Accounts. There are a few requirements for you to participate. Participation in the Budget Coach Program and attending a Credit Cafe workshop are required to access the match funds.

Also, your savings and matching funds can only be used towards the purchase of your car from Second Chances Garage.

How do we know Prosperity Accounts will be used as intended?

Provisions are built in to ensure compliance. Savers are informed of the eligible uses for Prosperity Accounts, and are motivated to comply because Prosperity Accounts provide a route to their dreams. Second Street & Hope provides the match funds when a saver is ready to purchase a vehicle and has completed all the program requirements.

Will I lose my Social Security disability benefits if I participate in a Prosperity Account?

No. Participating in a Prosperity Account (also known as Individual Development Accounts – IDAs) will NOT cause you to lose your Social Security disability benefits. Social Security disability benefits can be provided in two ways: through Social Security Disability Insurance (SSDI) or through Supplemental Security Income (SSI). For the former (SSDI), any resources or assets do not affect income when determining eligibility or when calculating benefit payment amounts. As for SSI, the Social Security website states explicitly that money saved in an Individual Development Account is not counted when determining SSI eligibility or when calculating benefit payments. Moreover, in response to a question about the affect of IDA savings on SSI benefits, the website states, “Your SSI benefit will not go down—it might even go up!" In addition, any interest earned on an individual’s own contributions is excluded from SSI’s definition of countable income and resources.

Do I need a lot of money to open a Prosperity Account?

The initial deposit to open a Prosperity Account is $50 for the Pathway to Transportation and $200 for the Pathway to Homeownership.

Where are savings deposited?

Certain designated financial institutions have agreed to establish special Prosperity Accounts, jointly owned by United Way of Frederick County and you.

Will I have access to my money once I deposit my savings into my account?

Because Prosperity Accounts are intended to help people purchase assets, withdrawals for non-asset uses are strongly discouraged. Participants are always free to close their accounts and withdraw from the program but will not receive the match for early withdrawal.

What if I have an emergency and need the savings I have put in my Prosperity Account?

All of our account holders will be allowed to withdraw their savings to help deal with emergencies that involve eviction, loss of a home, loss of employment, and medical emergencies. You'd be able to make this withdrawal without losing your match money, as long as you replace the emergency funds you’ve withdrawn.

How do I receive match funds?

Matching funds are provided by Second Street & Hope. A check will be issued directly to Second Chances Garage.

Where does all this match money come from?

Matching funds are provided by Second Street & Hope.

Is there a chance United Way of Frederick County won't have money when it comes time for me to buy the asset I've been saving for?

Matching money is based on availability of funds from the funding partner.