Eligibility Guidelines

Check below to see if you qualify for a Prosperity Account:

- Be a resident and living in one of the following counties:

- MARYLAND: Frederick, Carroll, Howard, Montgomery, Washington

- WEST VIRGINIA: Morgan, Berkeley, Jefferson

- VIRGINIA: Loudoun

- PENNSYLVANIA: Franklin, Adams

- Ensure that no more than one Prosperity Account can be opened per household.

- Be at least 18 years old.

- Be currently employed, earning wages from full- or part-time work income.

- Have no more than $15,000 in NET assets, excluding one car and retirement savings.

- Meet earned income eligibility.

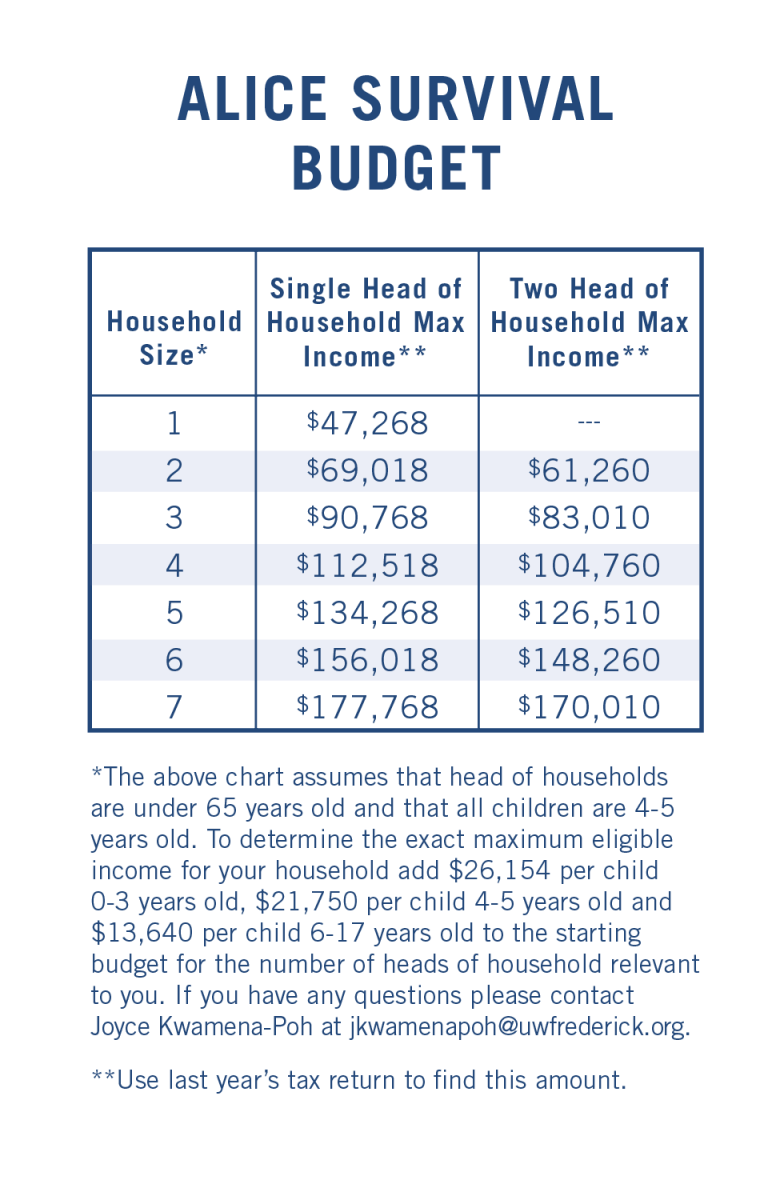

Income Eligibility by family size

Prosperity Account savers must commit to the following:

What is Required?

- Make monthly savings deposits of at least $25 (up to a maximum of $2,200 total savings during the program).

- Save in the program for a minimum of 3 and a maximum of 12 months

- Complete asset-specific training for selected asset goal prior to purchase

- Complete one hour of financial training per month of program enrollment

- Maintain monthly contact with Budget Coach

- Agree to abide by the program’s rules and responsibilities as described by the program staff and in the written materials received

- The saver must be able to attend the application interview at United Way of Frederick County as well as the account opening at ACNB Bank. The saver can take advantage of electronic banking (direct deposits, mobile check deposit through app) and email correspondence from there on after.

Provide an accurate household budget which includes their savings goal. Budget must be submitted prior to opening account. Also, provide a current credit report (less than 12 months old).

Net Worth Assessment

Net Worth is determined by taking the household’s total assets (what everyone in the household owns) and then subtracting the household’s total liabilities (what everyone in the household owes) to see if it has a value of more than $10,000.

The following are not included when determining net worth:

- The applicant’s retirement savings.

- One vehicle (asset), and associated liabilities (outstanding loan). The asset portion of the vehicle is calculated from the Trade-In Value.

Click HERE for a Net Worth Assessment.

Household Earned Income (To determine program eligibility)

When determining eligibility, gross income is used. All applicants must document their income level and meet the following household eligibility income and net worth eligibility requirements to participate in the program:

In order to be income eligible, the applicant’s household eligibility income must not exceed the income guidelines (200% of Poverty, EITC or TANF eligible) based on the people in their household. A household consists of anyone living in the same primary dwelling – this includes spouses, children, parents, siblings, etc. that share an eating and living space.

Household Eligibility Income includes:

- All Employment (Wages and Self)

- Workers Compensation

- Unemployment

- Alimony

- Investment Income

- Retirement/Pension Income

- Rental Income

Household Eligibility Income does not include:

- Child Support

- Social Security Benefits

- Other Benefits (TANF, Food Stamps, etc.)

- Section 8 Assistance

- If an employee pays for disability insurance

Enrollment and participation in the Prosperity Account program does not affect any public assistance participants may be receiving.

Household Earned Income (To determine employment funds for deposit)

Prosperity Account savings dollars must be derived from household earned income, which includes employment earnings and self-employment earnings (earned income is defined by the U.S. Internal Revenue Code of 1986).

Generally speaking, Household Earned Income (money received for services rendered) includes:

- Wages, salaries, tips

- Net earnings from self-employment

- Work Study

- AmeriCorps stipend

- Foster care income from the State

- Disability Insurance Income (only if the employer pays for the insurance – if the employee pays for insurance, it does not count as earned income)

All Prosperity Account savers must have a source of income during the savings period. Savers cannot open a Prosperity Account until they verify there is earned income in the household from a job or a business. An individual who receives only Social Security income (or any other benefit income) cannot be a Prosperity Account saver because benefit income is not considered earned income. However, if someone else in the household has earned income, the Social Security benefit earner can save using that other person’s earned income.

Acceptable Earned Income Verification Documentation (for both eligibility and employment)

- Copies of paychecks or pay stubs from within the past 30 days

- Written statements from employers regarding employment within the past 30 days

- Letters or other documents from income sources, if dated within the last 30 days

- If self-employed, accounting and other business records showing net income

- Most recent tax return

- Capital gains

- Any assets drawn as withdrawals from a bank, the sale of property, a house or a car

- Tax refunds, gifts, loans, lump sum inheritances, one-time insurance payments, or compensation for injury

- Non-cash benefits such as employer paid or union paid portion of health insurance or other employee fringe benefits, food or housing received in lieu of wages, the value of food and fuel produced and consumed on farms, the imputed value of rent from owner-occupied non-farm or farm housing, and federal non-cash benefit programs such as Medicare, Medicaid, food stamps, school lunches, housing and other emergency assistance.

- Any portion of Social Security benefits deducted to pay Medicare premiums that will not be reimbursed.

Do You Qualify? Click to see the Pre-qualification Survey.